Emissions but would have only a modest effect on the Earths climate without a worldwide effort. The coffee industry is responsible for 1694710 jobs in the US economy.

The Impact Of Taxation Economics Help

A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax.

. He said that if Americans arent willing to give their blood sweat and tears to achieve this common goal then it is not a suitable time to go. In this study each of the se majo r elements is. The level of consumer spending affects prices investment decisions and the number of workers that businesses employ.

Although a comprehensive aggregation across the different categories of literature is an important goal for future research simple addition of key effects identified in this review would suggest total annual economic costs associated with obesity in excess of 215 billion. Besides their findings also imply that the increase in social security. Economic arguments about tax reform which in a political economy context may be regarded just as changes in the tax system are provided in a mostly nontechnical manner in Slemrod and Bakija 2008.

During the beginning of the Space Race John F. The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers. They were created to prevent the perpetuation of tax-free wealth within the countrys most affluent families.

The Effect of Taxes on Debt. The new law lowered tax rates on ordinary income for individuals for almost all tax brackets and filing status. Tax r eceipts and a general rise in econonlic a c tivity pro portionate to the size of the basic inputs.

Many states also impose their own estate tax sometimes known as an inheritance tax. It was repealed but reinstituted over the years often in response to the need to finance wars. Lawmakers could increase federal revenues and encourage.

Opponents of these types of taxes believe. The first estate tax was enacted in 1797 in order to fund the US. I describe the role a domestic carbon tax could play in.

Some evidence on the economic impact of carbon taxes with a particular focus on the emissions and GDP impacts of British Columbias. According to the TCG a comprehensive tax system is one that promotes equity and fairness allow for sufficient growth and ensure and maintain its revenue integrity. Effects of a Carbon Tax on the Economy and the Environment.

The modern estate tax as we. The structure and financing of a tax change are critical to achieving economic growth. About one-third of the nations economy is based on government spending.

Direct impact includes all direct effects the organization has on the region due to the organizations operations. Up to 24 cash back economic impact. Most revenue for government spending comes from the collection of taxes.

Total Economic Impact. The economic climate has a big impact on businesses. The total economic impact of the coffee industry in the United States in 2015 was 2252 billion.

This article is concerned with taxation in general its principles its objectives and its effects. Consumers spent 742 billion on coffee in 2015. These kinds of changes will also send ripple-effects throughout a corporate tax department.

However taxes affect the cost of capital from different sources of capital in different ways. The overall economic impact of obesity in the US appears to be substantial. The law waives federal income taxes on up to 10200 in unemployment insurance.

Ordinary tax rates reduced. If for example the corporate tax rate in the US. Herltage DataChad 3 Bdget Baselines Historical Data and A lternatives for the Future office of Management and Budget Washington D.

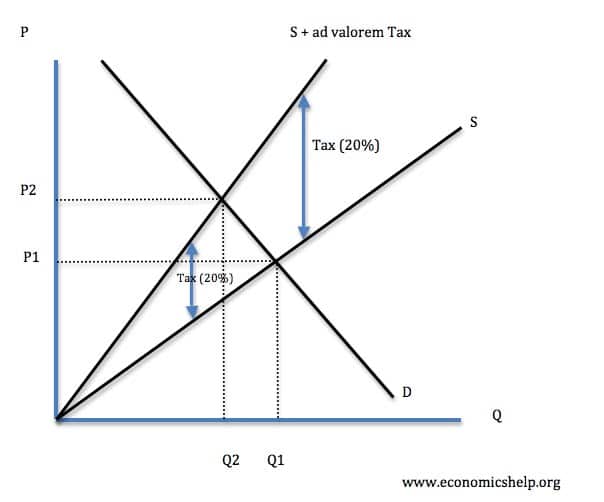

Specifically the article discusses the nature and purposes of taxation whether taxes should be classified as direct or indirect the history of taxation canons and criteria of taxation and economic effects of taxation including shifting and incidence identifying who bears the. In many tax jurisdictions interest on debt financing is a deduction made before arriving at the taxable income of a company. Kennedy made it very clear that if America is going to achieve the goal of going to the moon then Americas are going to have to sacrifice.

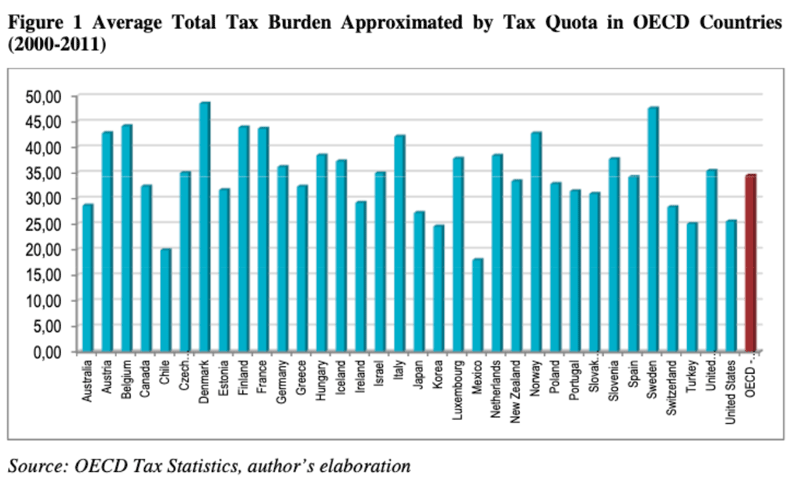

This paper examines how changes to the individual income tax affect long-term economic growth. Coffee-related economic activity comprises approximately 16 of the total US. Tax levels in the average industrialized coun- try that belongs to the Organization for Econom- ic Cooperation and Development OECD was over 2 percentage points higher than in Canada in 2004 359 of GDP and in the average Euro- pean country it was almost 5 percentage points higher 383 of GDP.

It decreased the top rate to 37 in 2018 from 396 in. The total impact of an organization is a compilation of the direct impact the indirect impact and the induced impact generated in the economy as a result of the organization. In tax on real GDP per capita is negative and persistent where an increasing in the total tax rate which measures as the total tax ratio to GDP by 2 of GDP has a long-run effect on real GDP per capita of -05 to -1.

The maximum top estate tax rate is 40. The tax would help reduce US. As mentioned in section 1 tax generates important revenue for the government and also serves as a mechanism to reduce unwanted activity.

Were reduced to 25 most people would expect a. The government impacts the economy through the goods and services it purchases and provides. Taxes can have a significant impact on the weighted average cost of capital WACC of a company.

Work on how the economic effects of taxation are evaluated in political terms by political parties and voters is discussed in later. Estate taxes are imposed on the transfer of property upon the death of the owner. The economic impact will be felt in all parts of the state primarily in terms of increased tourist volume and the facilities and service employment it will require.

Taxes and Wick New Evidence Joint Economic Committee. When the economy is growing consumers earn more and make more purchases.

The Impact Of Taxation Economics Help

0 Comments